When considering an Executive Condominium (EC) HDB as your home, it's important to understand the eligibility criteria and application process, which involves being a Singapore citizen or a couple with at least one Singaporean, and not owning any other residential property. Design-wise, a focus on open-concept layouts, natural lighting, energy-efficient fixtures, durable materials, and smart home technology will create a functional, aesthetically pleasing, and adaptable living space within the HDB framework. Proper maintenance is also paramount as it preserves your EC's value, ensuring that it remains in excellent condition for your enjoyment and maintains high resale potential. As an investment, maintaining your EC to high standards aligns with market expectations and maximizes its appeal to future buyers.

Exploring the pathway to Executive Condominium HDB ownership is a pivotal step for those aspiring to transition from public to private housing. This article demystifies the process, offering insights into the unique status of ECs within Singapore’s residential landscape. From eligibility criteria to financial planning and design preferences, we guide you through each facet of securing an Executive Condominium. Whether you’re a first-time homebuyer or looking to upgrade, this comprehensive guide ensures you make informed decisions for your future home.

- Understanding Executive Condominiums (ECs) and Their Unique Position in the HDB Scheme

- The Evolution of ECs: From Public to Private Housing

- Eligibility Criteria for Applying for an Executive Condominium HDB

- Financing Your Executive Condo: A Guide to Mortgages and Loans

- The Application Process: Steps to Secure Your New Executive Condo Home

- Design and Layout Considerations for Prospective EC Owners

- Maintenance and Resale Value: Keeping Your EC in Prime Condition

Understanding Executive Condominiums (ECs) and Their Unique Position in the HDB Scheme

Executive Condominiums (ECs) represent a unique housing option within Singapore’s diverse residential landscape, serving as a bridge between public and private housing. These hybrid developments are developed and sold by private developers but are part of the Housing & Development Board (HDB) scheme, allowing eligible couples and families to own a larger flat in a condominium setting at subsidized prices. Unlike traditional HDB flats, ECs offer the added benefits of condominium living, such as facilities like swimming pools, gyms, and playgrounds, which cater to the diverse needs of residents. Prospective homeowners considering an EC must understand that while they enjoy certain public housing privileges, such as eligibility for a CPF Housing Grant, they also come with market-rate pricing after the Minimum Occupation Period (MOP). This makes ECs an attractive option for those who aspire to upgrade from a HDB flat but are not yet ready to transition to full private property ownership. It’s crucial for individuals interested in Executive Condominiums to familiarize themselves with the HDB regulations and guidelines, as these residences come with specific eligibility criteria and resale conditions post-MOP. Understanding the nuances of ECs within the HDB scheme is essential for those looking to balance the benefits of condominium living with the affordability and stability offered by public housing.

The Evolution of ECs: From Public to Private Housing

Eligibility Criteria for Applying for an Executive Condominium HDB

When considering the purchase of an Executive Condominium (EC) by the Housing & Development Board (HDB), it’s crucial to understand the eligibility criteria set forth by the CPF (Central Provident Fund) and HDB policies. For Singaporean couples, at least one applicant must be a Singapore citizen, and both must not own another flat at the time of application. Additionally, applicants’ total household income should not exceed the limits set by the HDB. Upon acquiring an EC, owners can live there for a minimum of 5 years before it becomes a regular condominium, after which they can sell it on the open market.

In terms of housing grants, first-timer applicants may be eligible for the CPF Housing Grant or the Proximity Opportunities grant if their EC is within 4 kilometers of their parents’ flat. To apply, interested parties must engage an appointed salesperson from a real estate developer and submit their applications through the salesperson, ensuring all eligibility criteria are met before proceeding with the application for the EC unit. It’s important to keep abreast of these guidelines as they can change over time, and specific conditions apply for those who have previously owned an HDB flat or an EC. Prospective buyers should also consider the resale levy if they are upgrading from a resale HDB flat to an EC, which they may need to pay upon acquiring the new unit.

Financing Your Executive Condo: A Guide to Mortgages and Loans

When considering the purchase of an Executive Condominium (EC) under the Housing & Development Board (HDB), understanding your financing options is crucial. Prospective owners have several mortgage and loan avenues to explore, each with its own set of terms and conditions tailored to fit different financial scenarios. The HDB Concessionary Loan Scheme for ECs offers preferential interest rates for Singapore Citizens, making it an attractive option for those who qualify. This scheme is designed to assist with the initial down payment, thereby reducing the financial burden on buyers. Additionally, commercial banks and financial institutions offer a range of housing loans for ECs, often with competitive interest rates and flexible repayment schemes. It’s advisable to compare these options carefully, taking into account factors such as loan tenure, early repayment penalties, and eligibility criteria, which can vary between lenders. Prospective buyers should also be aware of the Total Debt Servicing Ratio (TDSR) framework set by the Monetary Authority of Singapore, ensuring that monthly mortgage payments do not exceed a significant portion of one’s monthly income. By meticulously assessing your financial situation and exploring these financing options, you can make an informed decision on the most suitable mortgage for your Executive Condominium HDB purchase.

The Application Process: Steps to Secure Your New Executive Condo Home

Embarking on the journey to secure an Executive Condominium (EC) under the purview of the Singaporean government involves a structured application process tailored for eligible applicants. Prospective owners must first meet the eligibility criteria set forth by the Housing & Development Board (HDB), which includes being a Singapore citizen or a couple with at least one Singapore citizen, and not owning another flat from the date of application.

To initiate your application for an EC, start by obtaining the necessary information from the HDB website or visiting a HDB service center. You will need to complete the Application for Allocation of Flat form, which includes details of your income ceiling, preferred flat type, and desired location. Once your application is submitted, it enters the selection balloting process, where successful applicants are chosen based on criteria such as household size, income ceilings, and the order of application. Upon selection, you will be invited to book your EC unit. The subsequent steps involve selecting your preferred unit from those available, finalizing the price through the open market pricing mechanism, and signing a lease agreement with HDB before construction commences. Throughout this process, it is crucial to stay informed about any updates or changes to the application criteria or procedures as stipulated by the HDB.

Design and Layout Considerations for Prospective EC Owners

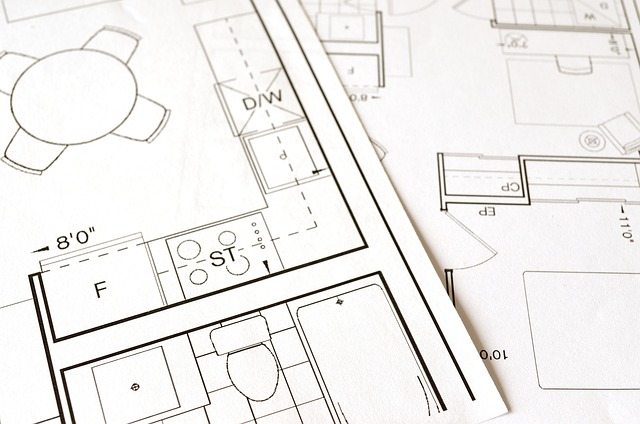

When considering the design and layout of an Executive Condominium (EC) unit, prospective owners should prioritize elements that enhance both functionality and aesthetic appeal. The interior space should be carefully planned to accommodate the dynamic lifestyle needs of families, with open-concept living areas that foster interaction while maintaining privacy. A well-thought-out floor plan that allows for flexibility in room usage is particularly valuable, as it can adapt to changing family requirements over time. Additionally, smart storage solutions and multi-purpose spaces can significantly improve the practicality of an EC unit within the HDB ecosystem.

Moreover, lighting plays a crucial role in setting the ambiance of a home; hence, large windows or skylights should be incorporated to maximize natural light. Energy-efficient lighting fixtures not only contribute to the visual appeal but also reduce energy consumption. When selecting finishes and materials for surfaces such as flooring, countertops, and cabinets, durability and ease of maintenance should be considered to ensure long-term satisfaction with the home environment. Prospective EC owners should also look into the potential for future enhancements, such as smart home technology integrations, which can add convenience and value to their residence within the HDB framework. By carefully considering these design and layout elements, EC owners can create a living space that is both enjoyable and adaptable to their evolving needs.

Maintenance and Resale Value: Keeping Your EC in Prime Condition

When considering an Executive Condominium (EC) as your home, it’s crucial to understand the importance of maintaining its value over time. The resale value of your HDB-managed EC is significantly influenced by its condition and how well you’ve kept up with maintenance requirements. Regular upkeep isn’t just about aesthetics; it ensures that all functional components of your unit are in optimal working order, which can add to the overall appeal for potential buyers when the time comes to sell. Prospective buyers typically assess an EC’s condition carefully, as they understand that living in an HDB-managed EC comes with a set of advantages but also certain maintenance responsibilities. To maximize your EC’s resale value, focus on maintaining high standards of cleanliness and repair. This includes timely fixes for any issues, keeping common areas well-maintained if you live in a multi-unit property, and ensuring that any renovations comply with HDB guidelines to avoid future complications during resale. By treating your EC as a long-term investment and maintaining it diligently, you’ll not only enhance your living experience but also position yourself to capitalize on its market value when the time is right. Remember, an Executive Condominium HDB that’s well-maintained will always stand out in the resale market, making it a prime asset for discerning buyers.

When pursuing an Executive Condominium HDB, prospective owners have a clear path through the information provided in this article. From grasping the unique status of ECs within the HDB scheme to understanding the eligibility requirements and financing options available, individuals are well-equipped to navigate this journey. The detailed application process outlines each necessary step to secure an EC, ensuring that potential homeowners can make informed decisions. Design considerations and maintenance practices are crucial for maintaining an EC’s value over time, particularly when it comes to resale. By following the guidelines outlined, from initial eligibility checks to long-term upkeep, individuals can confidently embrace the Executive Condominium lifestyle. This comprehensive guide serves as a vital resource for those looking to make an EC their new home.